(a) The dealer is a corporation doing business under the laws of this state or is a person domiciled in, a resident of, or a citizen of, this state. 212.06(2)(c) who makes a remote mail order sale is subject to the power of this state to levy and collect the tax imposed by this chapter when any of the following applies: (1) For purposes of this chapter, a “ remote mail order sale” is a retail sale of tangible personal property or services taxable under this chapter which is, ordered by mail, telephone, the Internet, or other means of communication, from a dealer who receives the order outside of this state in another state of the United States, or in a commonwealth, territory, or other area under the jurisdiction of the United States, and transports the property, or causes the property to be transported, or provides the services whether or not by mail, from any jurisdiction of the United States, including this state, to a person in this state, including the person who ordered the property or services. So it is feasible that online travel companies and vacation rental web sites, like VRBO, HomeAway, and AirBNB would not be considered remote sellers under the proposed legislation.īelow are the proposed revisions to section 212.0596, F.S., which would create and economic nexus statute in Florida: One other interesting thing about the proposed legislation is that the changes only apply to sellers of taxable tangible personal property and services, but not the rental of real property.

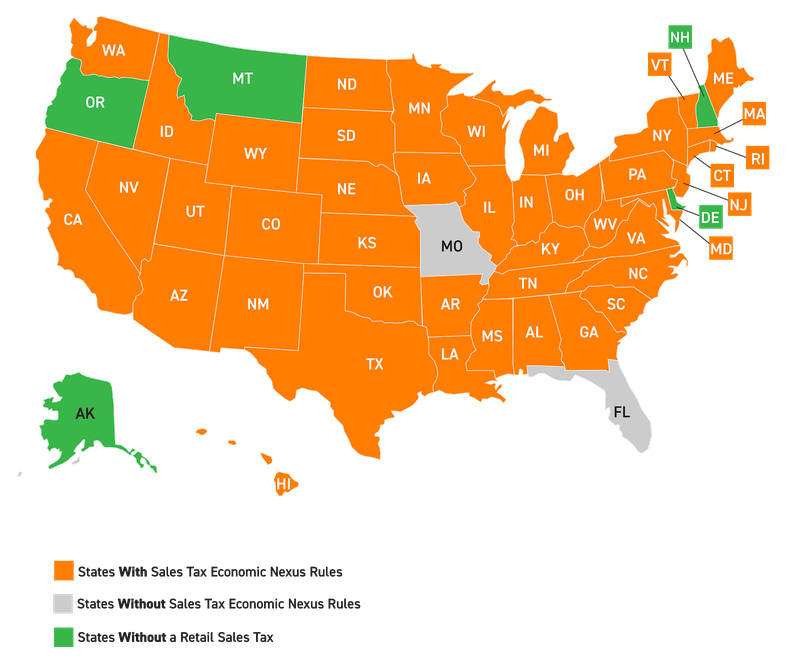

So a wholesale company who has $100,000+ sales into Florida that are 100% exempt under the sale for resale exemption would still be considered to have economic nexus under this bill. The statute also appears to apply to sales of goods are services that are taxable under Chapter 212, even if the sales are ultimately exempt from sales tax. The prior mail order statute exempted out of state sellers from collecting the local surtax, but that exemption has been removed in the proposed bill. The proposed legislation would modify section 212.0596 to include “remote sales” of a “substantial number,” which is defined as 200 or more separate retail sales of tangible person property or services taxable under Chapter 212 or more the $100,000 of such sales in the previous calendar year. Senate Bill 1112 was introduced on Februwith proposed legislation to modify Florida’s mail order nexus statute to mimic South Dakota’s law. It appears that Florida will also be jumping on the economic nexus bandwagon. So if your company (or your client) is selling across state lines and sells more than $100,000 or does more than 200 transaction into any remote state with a sales tax, then it is probable that you have sales tax liabilities accruing in those states. As of the date of this article, 30 states have enacted economic nexus laws with varying effective dates. With the Court’s holding in South Dakota v Wayfair, the physical presence bright line standard is no more and a level of economic activity (sales) into the state is all that is required to remove the handcuffs from the state’s taxing jurisdiction on remote sellers. The US Supreme Court, interpreting the Commerce Clause, denied a state from having jurisdiction over a remote seller that did not have a physical presence in that state. In what seems like a prior life, multistate sales tax used to be easy if your business only had physically presence in one state.

Continue reading for further explanation on these two types of statutes and the text of the statutes themselves. The legislation, if enacted, would be effective July 1, 2019.

Oh… and the bill also suggested reducing the sales tax on commercial rent from 5.7% to 4.2%, presumably funded by the increase in sales tax review from these new nexus laws. Interestingly, the proposed statute would not only create an economic nexus law, but would also create what is commonly known as a “marketplace facilitator” statute as well. Florida was highly expected to jump on the bandwagon and Florida Senate Bill 1112 was introduced to do just that. The individual state laws vary slightly with the dollar threshold or the number of transactions, but they are all very similar. Mimicking South Dakota’s law, most states are enacting laws that assert taxing jurisdiction over out of state companies that sell more than $100,000 of taxable goods or services OR 200 or more transactions into the state. In the wake of the South Dakota v Wayfair US Supreme Court holding on June 21, 2018, states around the country have been scrambling to create new “economic nexus” laws.

0 kommentar(er)

0 kommentar(er)